Access all In Easy Steps books for just £5 a month

Menu

Since April 2010 all large and medium sized companies, most small traders and all newly registered VAT traders have been required to file their VAT returns online and pay electronically; paper submissions no longer being accepted. If you didn’t choose to set up VAT e-Submission during the setting of your VAT Preferences, you can do so now, as follows:

Step 1

Visit the HMRC website and obtain your e-Submission Credentials

Step 2

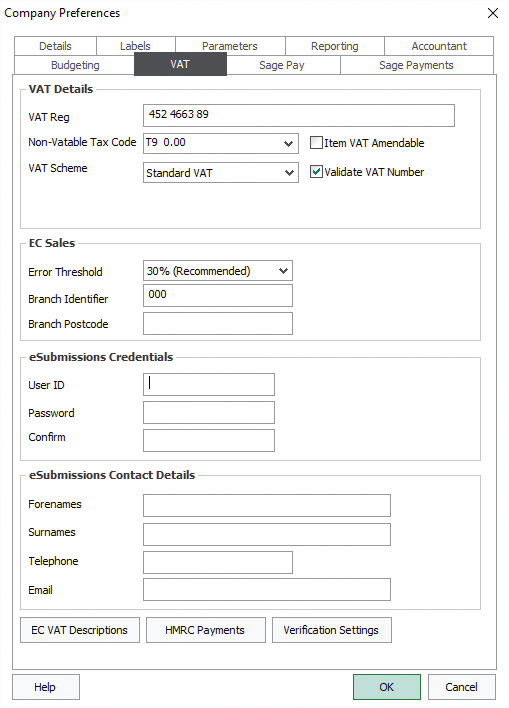

From the Sage 50 menu click Settings, Company Preferences, then VAT

Step 3

Enter your Credentials and Contact Details underneath eSubmissions and Credentials

Step 4

Enter HMRC Bank Account details after clicking the HMRC Payments button

Step 5

Click OK to save

Making an online VAT submission

Step 1

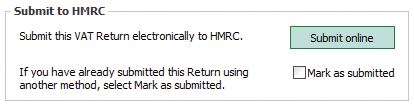

From the VAT Return click Submit online

Step 2

Once submitted, to pay or reclaim from HMRC, check payment details and Date then click Post Bank Payment

You can only make an online VAT submission for a return whose status is Pending or Partial. For a payment, the status must be Submitted but Not Paid.

For the essential guide to Sage 50 Accounts 2016, click here. Updated for Sage 50 Accounts for the 2016/17 financial year, Sage 50 Accounts 2016 in easy steps uses detailed images and easy-to-follow instructions, showing you how to quickly get to grips with the new features of this leading accounts software.